Shifting Dynamics in the Global Sports Betting Market

The global sports betting market is rapidly evolving, with major movements driven by economic, technological, and regulatory shifts. This week marked significant milestones as new entrants challenge established operators, real-time betting technologies redefine user expectations, and regulatory reforms—especially in Latin America—signal a new era of growth and market complexity. Understanding these betting market dynamics is now more critical than ever for operators, affiliates, and bettors seeking an edge.

Latin America Emerges as a Betting Powerhouse

Latin America’s sports betting industry has become the focal point of the global marketplace in May 2025. Brazil’s transition to a fully regulated online sports betting system, finalized only last week, resulted in over 1.4 million new sportsbook registrations within the first five days—a 28% increase in handle versus the year prior. This explosion is not isolated: Colombia and Mexico reported double-digit year-over-year growth in betting volume over the past month, attributed to increased digital adoption and strategic partnerships between international operators and local entities.

These trends echo the pattern seen in Europe during its early regulatory years, although Latin America’s consumer behavior skews younger and more digitally native. Notably, over 63% of new account holders in Brazil were aged 18–34, according to recent data from IBJR. Operators investing in localized payment solutions and real-time engagement features appear best positioned, as demonstrated by a 34% higher conversion rate in local football-centric campaigns compared to international promotions.

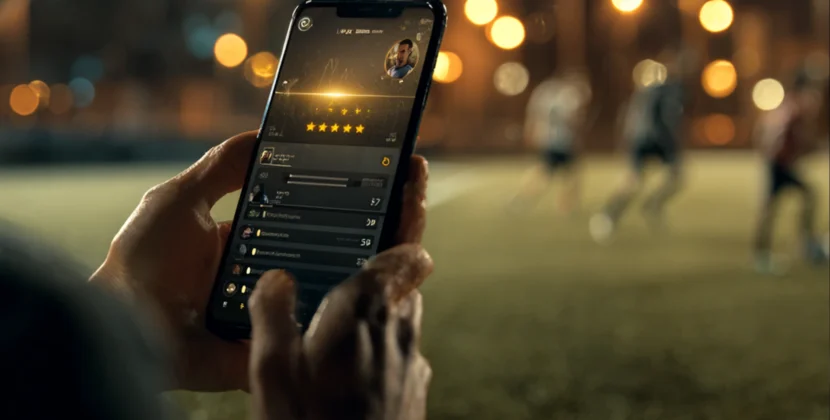

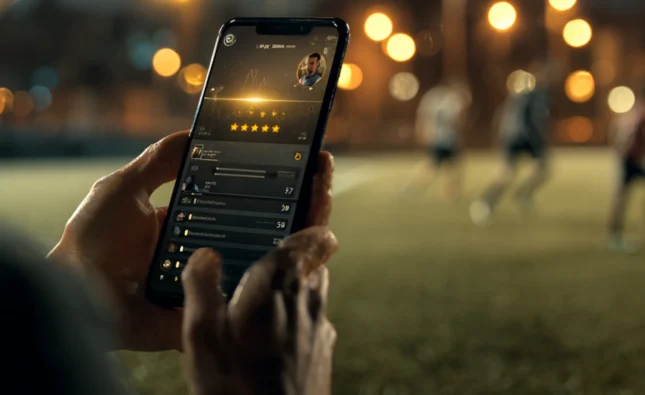

Surge in In-Play and Micro-Betting

In-play betting volumes reached new records this week, fueled by the UEFA Champions League Final and NBA Conference Finals. In the European market, live wagering accounted for 67% of all sports bets—a significant leap from the 59% recorded during the same period in 2024. The US market, still finding its in-play footing, reported a 22% week-on-week growth in live

handle.Micro-betting—wagers on discrete, short-duration outcomes such as the “next goal” or a player’s points scored in a quarter—continues to surge, particularly among Gen Z and Millennials. Recent BetRadar analytics revealed that 51% of all in-play wagers for the Champions League Final were placed on micro-markets, up from 38% last year. Operators equipped with fast-settlement technology reported that over 80% of these markets paid out within 90 seconds, boosting re-bet rates and session times.

Regulatory Developments Driving Confidence

The proliferation of regulated markets is enhancing bettor confidence and attracting fresh capital. This week, the UK Gambling Commission and New Jersey’s regulator jointly issued updated compliance frameworks for real-time betting products, emphasizing session limits, rapid exclusion tools, and proactive monitoring of betting spikes. Meanwhile, Brazilian regulators have initiated a nationwide campaign to educate consumers about identifying licensed operators, resulting in a 17% rise in legal site traffic.

Simultaneously, responsible gaming technology adoption is gaining momentum. Across the top five regulated jurisdictions, average user session times have dropped by 6% since Q1, but average deposit per session remains steady—a sign that player protections are working as intended without harming operator revenues.

Competitive Landscape and Strategic Partnerships

Tier-one operators are pivoting strategies to secure market share amid increased competition. This week alone, two major European brands acquired controlling stakes in Latin American bookmakers worth over $140 million, seeking operational synergies and local brand credibility. Affiliates and online communities are also diversifying by emphasizing region-specific content and collaborating with local influencers—resulting in a 29% improvement in first-time depositor conversions during high-profile events.

Looking Forward: Adaptation is Key

The global betting market’s dynamism this week is a testament to rapid adaptation and innovation. Operators able to localize user experience, adapt to shifting regulatory demands, and capitalize on real-time engagement tools will shape the next stage of industry growth. For both new entrants and industry veterans, understanding and responding to these dynamic trends is not just advantageous—it is essential for sustained success in the evolving world of sports betting.